Share on

A professional startup pitch deck, also known as an investor pitch deck, is a startup’s introduction to investors. It is an elaborative multimedia presentation that startups put together when looking to raise funds.

The main intention behind creating the pitch deck is as follows -

- Communicate the business idea quickly and efficiently to potential investors.

- Build trust and credibility with potential investors.

- Highlight key areas of a business (revenue model, GTM, market analysis) that are important to investors to make a calculated decision.

It exhibits the overview of the startup, which helps investors to evaluate the startup. Therefore, it is essential to include key details in the pitch deck before sending them to investors.

How to create a professional startup pitch deck for investors?

There are numerous pitch deck templates available on Google proclaiming “best pitch deck templates for seed funding” and “best pitch deck template for investors” Ironically, they all have one thing in common – these 11 slides -

‘Vision & Mission’ Slide

Every professional pitch deck starts with a small overview capturing the startup’s who, what, where, how, and why.

It is the hook startups use to reel investors’ attention through concise communication.

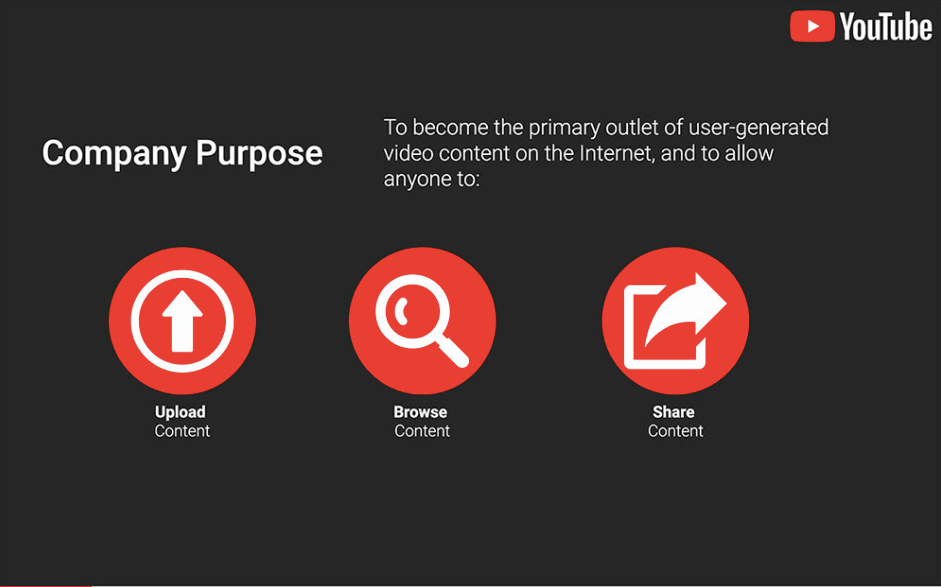

Example of ‘Vision and Mission’ slide – YouTube Pitch Deck

A great pitch deck is about getting potential investors excited about your idea, and YouTube successfully manages to do that with short, crisp copy and visuals.

‘Problem’ Slide

Investors want to finance the idea because of the following two reasons –

- When they feel the problem you’re trying to solve is relevant to the masses.

- Given their expertise, they understand the problem and the possibilities of generating ROI down the line.

It is an excellent opportunity to emphasize “What gap your product is filling in the market?” in your pitch deck.

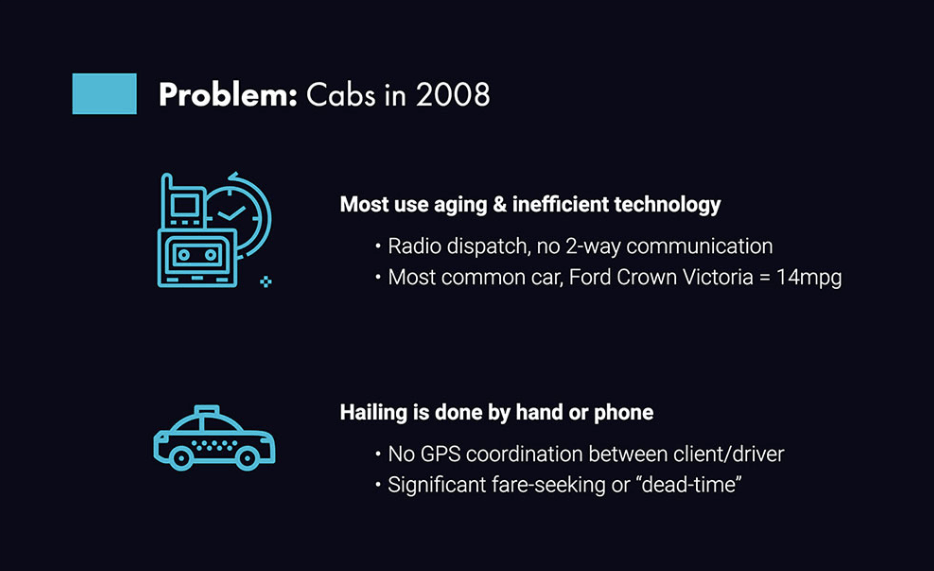

Example of ‘Problem’ slide – Uber Pitch Deck

The way Uber conceptualized the pain points of commuters while defining the problem, helped the investors to understand their business and goals.

‘Solution’ Slide

It is time to emphasize how your product or service alleviates the problem of the masses. Mind you, it's not the problem; it's the solutions that investors invest in.

Describe how your product or service addresses the problems outlined in slide two with less content and visuals.

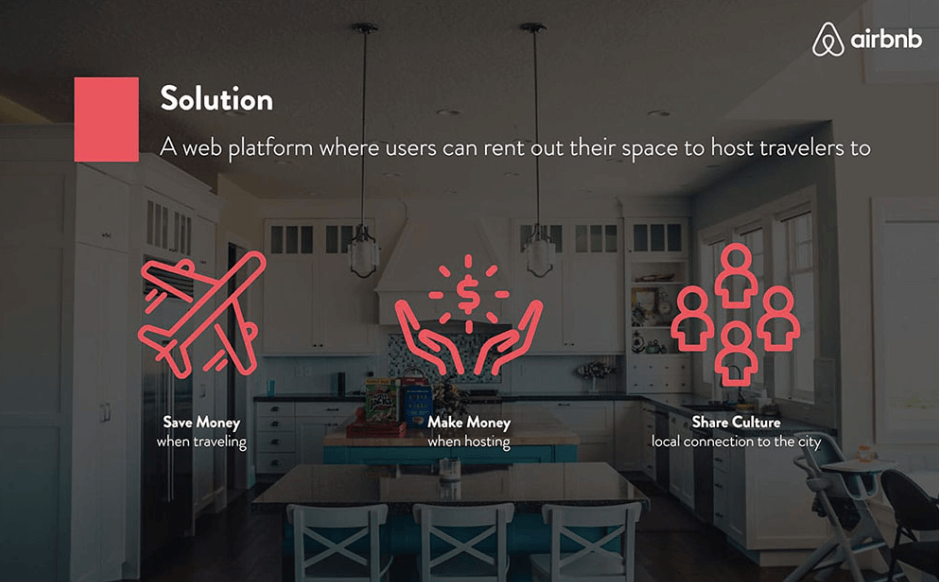

Example of ‘Solution’ slide – Airbnb Pitch Deck

Airbnb uses visuals to describe the solution, as showing is always better than telling.

'Market Size and Opportunity' Slide

Through the ‘Market Size’ slide, expand on the following –

- Total Available Market (TAM) - Total market for the product.

- Serviceable Available Market (SAM) - Segment of the total market applicable for your product.

- Serviceable Obtainable Market (SOM) - Market sub-segment that a startup can realistically achieve given limitations like location, competition, team capacity, etc.

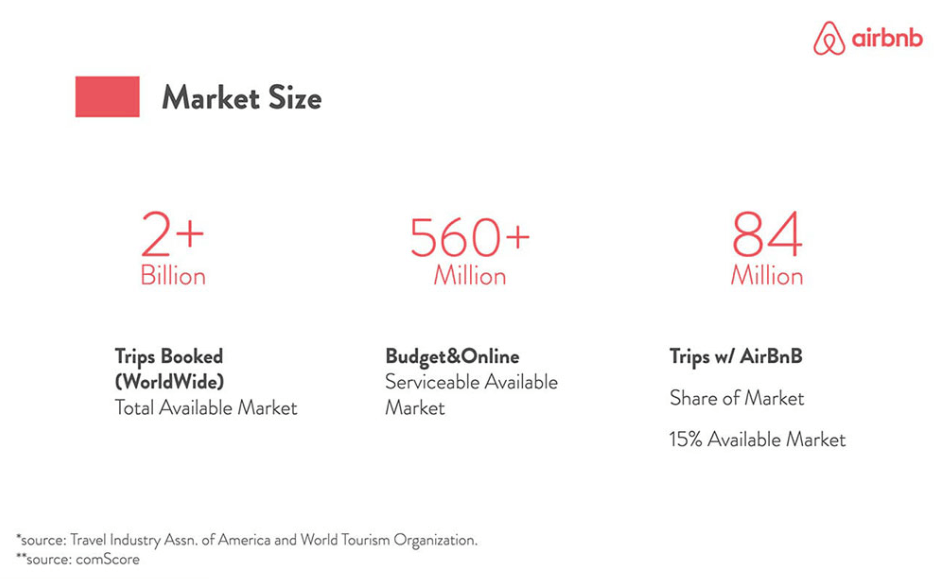

Example of ‘Market Size & Opportunity’ slide – Airbnb Pitch Deck

"Big market size excites the investors. The probability of raising funds diminishes if the market size is small, irrespective of the business idea.”

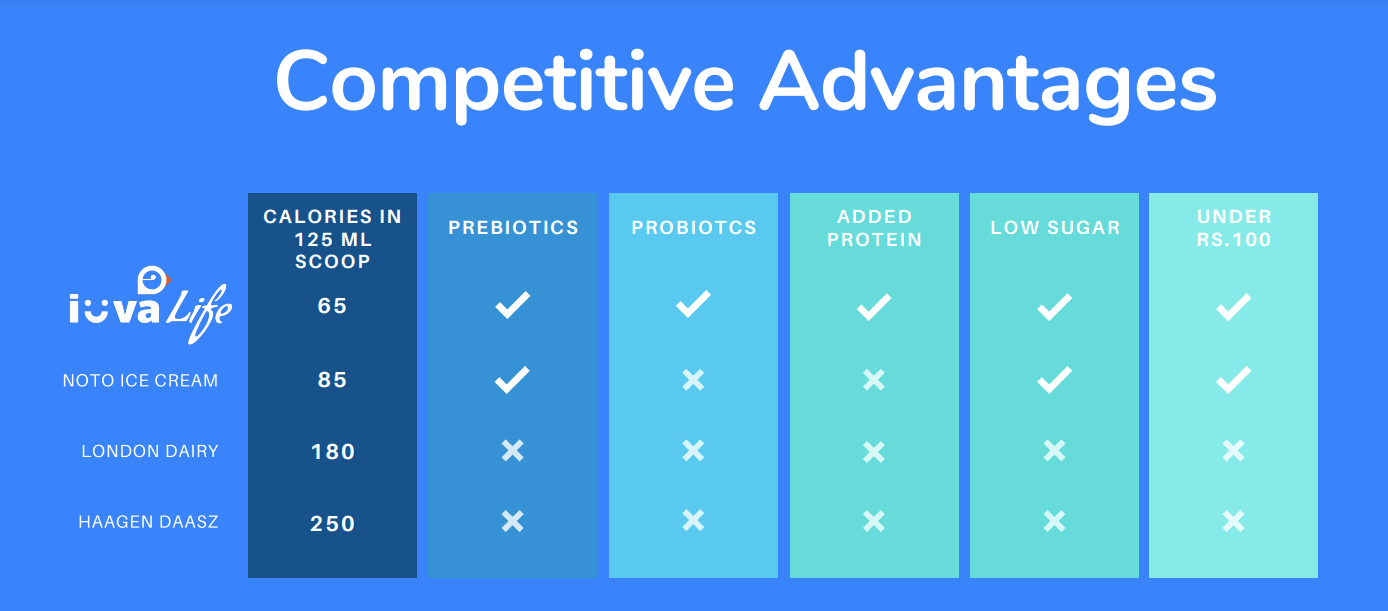

‘Competitive Advantage' Slide

Startups add a comparative narrative to establish themselves, among the alternatives available in the market, as the dominant force in the competitive landscape.

It is the opportunity to showcase to investors the impact your product and service can make.

Example of ‘Competitive Advantage’ slide – IUVA Foods

Use a graph or chart to make it convenient for the investors to review and compare.

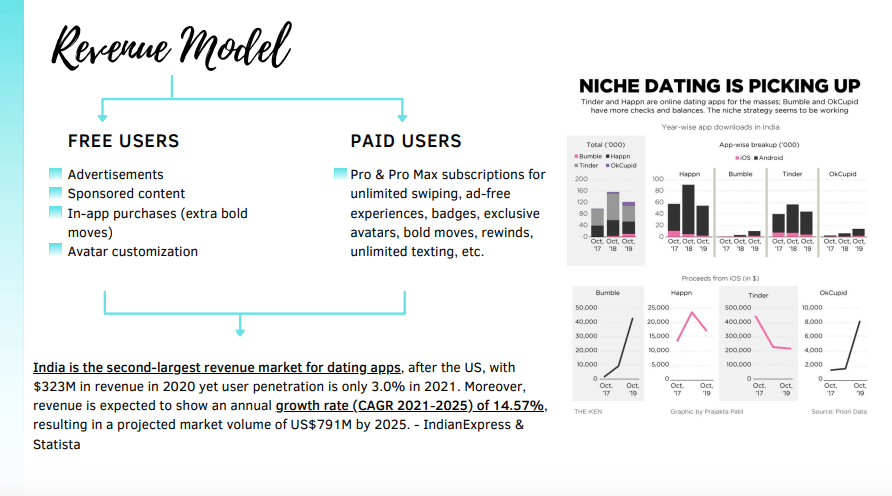

'Revenue Model' Slide

No matter how bright the idea is, it doesn't go very far if it doesn't make money. So investors want to know how a startup intends to generate revenue.

The ‘Revenue Model’ slide expands on the models (subscription-based, one-time payment model, etc.) your startup is employing to generate revenue.

Example of ‘Revenue Model’ slide – Chance App

This is the ‘make or break’ slide in your pitch deck. Since this slide offers validation to your business model, investors use this slide to evaluate the credibility of your business model.

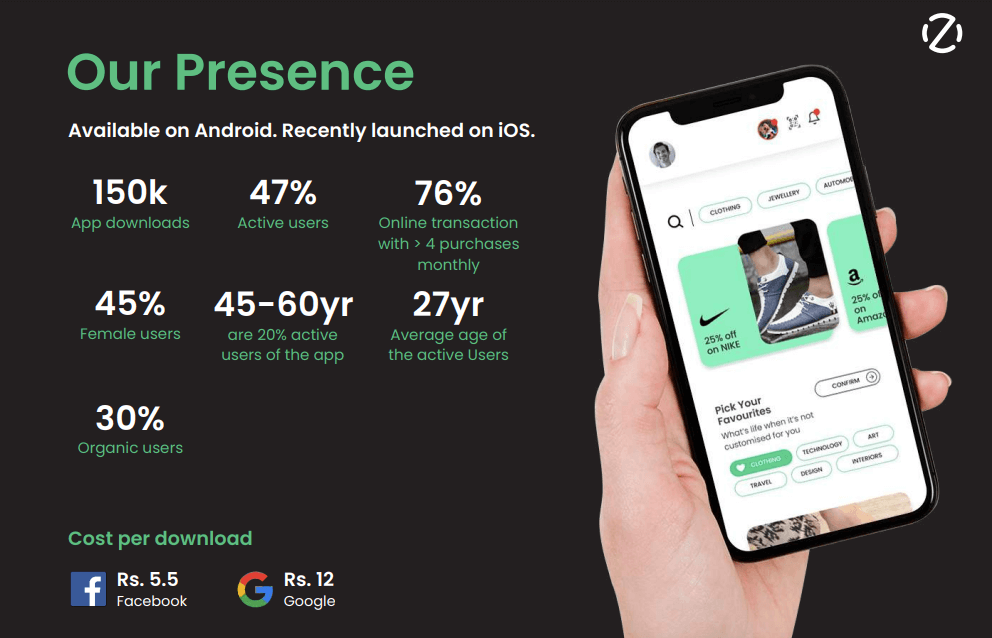

'Traction' Slide

Any proof that showcases that a business idea works in real time is a plus. In addition, getting traction at the early stage or BETA phase is a bonus that a startup should highlight in the pitch deck.

Example of ‘Traction’ slide – ZeroPay

The traction slide validates the ‘Financial Projection’ slide and justifies the valuation of the fundraising campaign. Adding figures to showcase that the startup has proven some aspect of the business model and scaling in the right direction is essential.

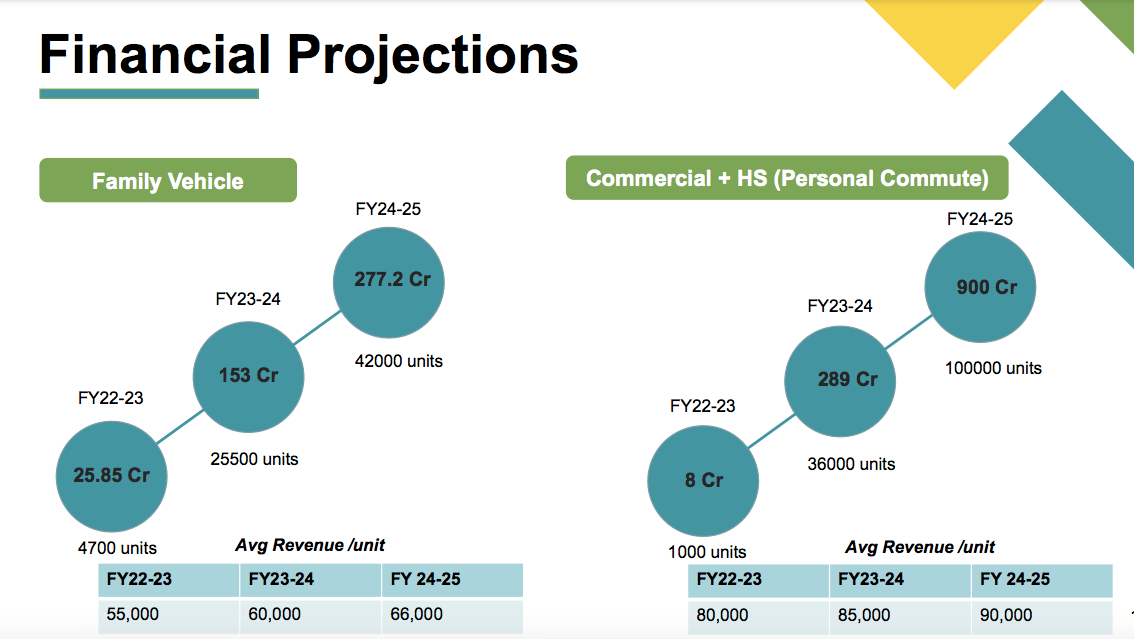

'Financial Projections' Slide

Why Financial Projections? What’s the need for financial projections? Before signing the cheque, investors expect to see the startup's growth, and that growth should also be reflected in financials like a sales forecast, income statement & loss, etc.

Example of ‘Financial Projections’ slide – Geliose Mobility

Considering the current business model, investors want to know how the startup will grow. Creating a three-to-five-year financial forecast with key metrics, such as the number of customers and conversion rate, helps investors evaluate the growth and make a consciously-driven decision.

'Highlights' Slide

Use this slide to brag about your startup! Highlight all the milestones, rewards, awards, recognitions, and grants your startup accumulated, any competition the startup has won, and other events and press releases in which the startup has been featured and recognized.

Example of ‘Highlights’ slide – Dectrocel

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.