Share on

A promising and lucrative opportunity is evaluated for its credibility, practical application, technology readiness level, and the value that it can provide to the consumer or, in a broader aspect, the world. Another important parameter is Return on Investment.

The seamless way to evaluate it is to harness the ROI (return on investment) tactics.

Hardly anyone would refuse that ROI is one of the best performance measures that help evaluate the investment's profitability.

By calculating ROI, investors can unlock potential investment opportunities and determine whether the money is well invested. It enables quantifying the profit or loss that an investment incurs when the money is invested in a business venture.

If you want an in-depth understanding of the ins and outs of the "return on investment," you shouldn't miss reading this blog.

What is the return on investment?

ROI is the profitability ratio that determines how much money is made and returned in direct proportion to the cost of the investment.

An ROI percentage is a metric that companies and venture capitalists leverage to assess the effectiveness of various investment activities. The better the ROI, the more the net profit and the lower the investment cost.

In other words, ROI is one of the KPI indicators to evaluate the overall financial performance and reflects business losses and profitability. Hence, ROI effectively determines the business's success and profitability over time.

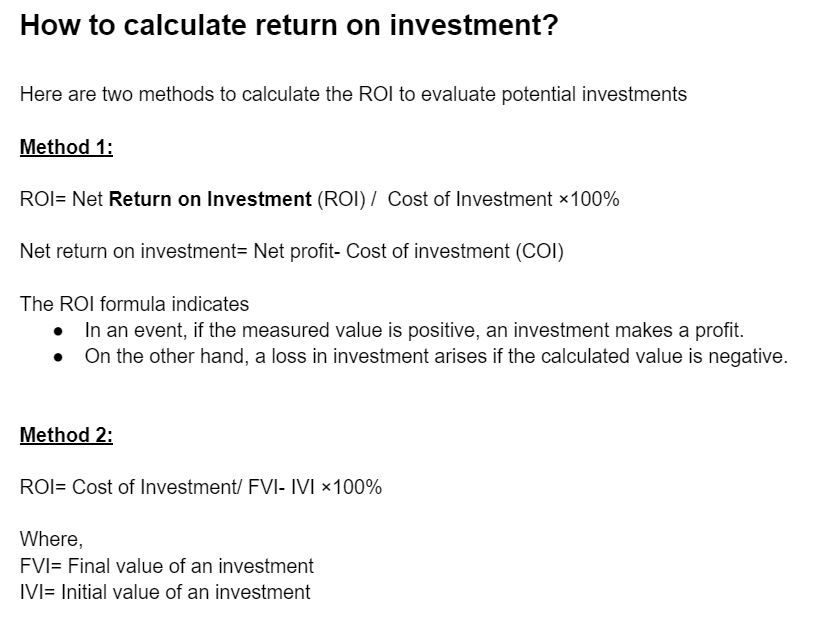

ROI calculations Examples

Example 1: If X investor invested $ 2000 in a dropshipping business in Z year and sold his share in the next year at $ 2800. In the same Z year, investor Y invested $ 1000 in a cleaning services business and sold them at $ 1200.

ROI can be calculated as follows:

Net profit- Cost of investment / Cost of Investment ×100% (first method)

The above example indicates that the dropshipping business is more profitable as its ROI is higher than the cleaning services business.

Example 2: X owns an online store and spends money on social media advertisements to generate more sales. He invests $1,500 in ads across social media platforms to draw buyers to his website during Christmas month.

When X checks his net profit, he discovers that his online store has made $4,500 more than it did last year.

The return on investment formula of the ads can be:

ROI= Net Return on Investment (ROI) / Cost of Investment ×100%

ROI =($4,500 / $1,500) x 100 % = 300%

Three main types of return on investment

The three main investment categories that yield returns are listed below-

Capital Gain

A gain in value that occurs from the sale of a capital asset is known as a capital gain. To put it another way, it is an economic concept in which you sell an asset for more money than you initially paid. The assets include

- Bonds

- Stocks

- Real Estate

Interest

Investment interest is the receiving of inflows on financial assets. The payout may occur every month, quarterly, or every year.

- Bonds, including Corporate Bonds, Secured Debentures, etc.

- Bank Account.

- Government Securities

Dividend

A dividend is a disbursement of a company's profit to its shareholders. When an organization makes money or has additional revenue, it can distribute some portion of it to its shareholders as dividends.

Three pivotal factors affecting the return on investment (ROI)

ROI is a crucial factor in evaluating the success of any business, and many factors need to be considered when measuring the business ROI:

1. Quality of products & services No one can disagree that great products and services lead to client retention. When the customer is satisfied, they will return to the brand and contribute to the sales, enhancing the chances of better ROI.

2. Marketing Expenditure It is another factor that is correlated with ROI. Marketing spending relies on the quality of a product. For example, suppose the quality of a product is below average than what is already available in the market. In that case, it will only increase the marketing cost and will not provide profitable results. On the other hand, if the product is of superior quality, it can compensate for the marketing spend and attract a good ROI.

3. Sales Revenue It is an important aspect that needs to be evaluated once an event is over. In sales revenue, it is essential to look at the sales pipeline and determine the total number of sales that have been closed after an event to predict the potential ROI.

Why is it essential to evaluate ROI?

ROI is a performance measure that helps determine their investment's efficiency and helps businesses achieve a competitive edge.

Let's plunge into some of the critical benefits that reflect the importance of evaluating ROI

1. Budget viability Return on investment helps gain relevant insights into how the money is spent. Suppose a business discovers that its marketing strategy needs to be fixed. In that case, it can revamp its strategy to optimize its spending for achieving the desired endeavors and, ultimately, save money for projects that will lead to higher ROI.

2. Pivot your marketing strategy Measuring marketing ROI can guide you in revising your strategy in response to client behavior. Let's say- If your marketing ad spending is $ 1200 but cannot achieve the desired outcomes; in that case, your business is only spending money, not generating any return. When you calculate your ROI, you can evaluate your whole marketing strategy. Hence, you will know what marketing strategies need to be modified to maximize the returns.

3. Setting up goals Once you examine your return on investment, you'll be ready to invent appropriate goals based on performance analytics to identify the room for improvement. You can begin creating long-term goals rather than only concentrating on the short term. ROI percentage will provide insights to revamp the entire marketing plan. You can revamp the entire strategy to achieve the desired goals.

4. Evaluate business decisions Evaluating past business decisions and devising future decisions can be analyzed by measuring the ROI to understand the worth of the investment.

5. Gear up for new opportunities Utilizing a return on investment calculator allows for measuring ROI, which provides information to unlock the potential of new opportunities and decide which are best to pursue.

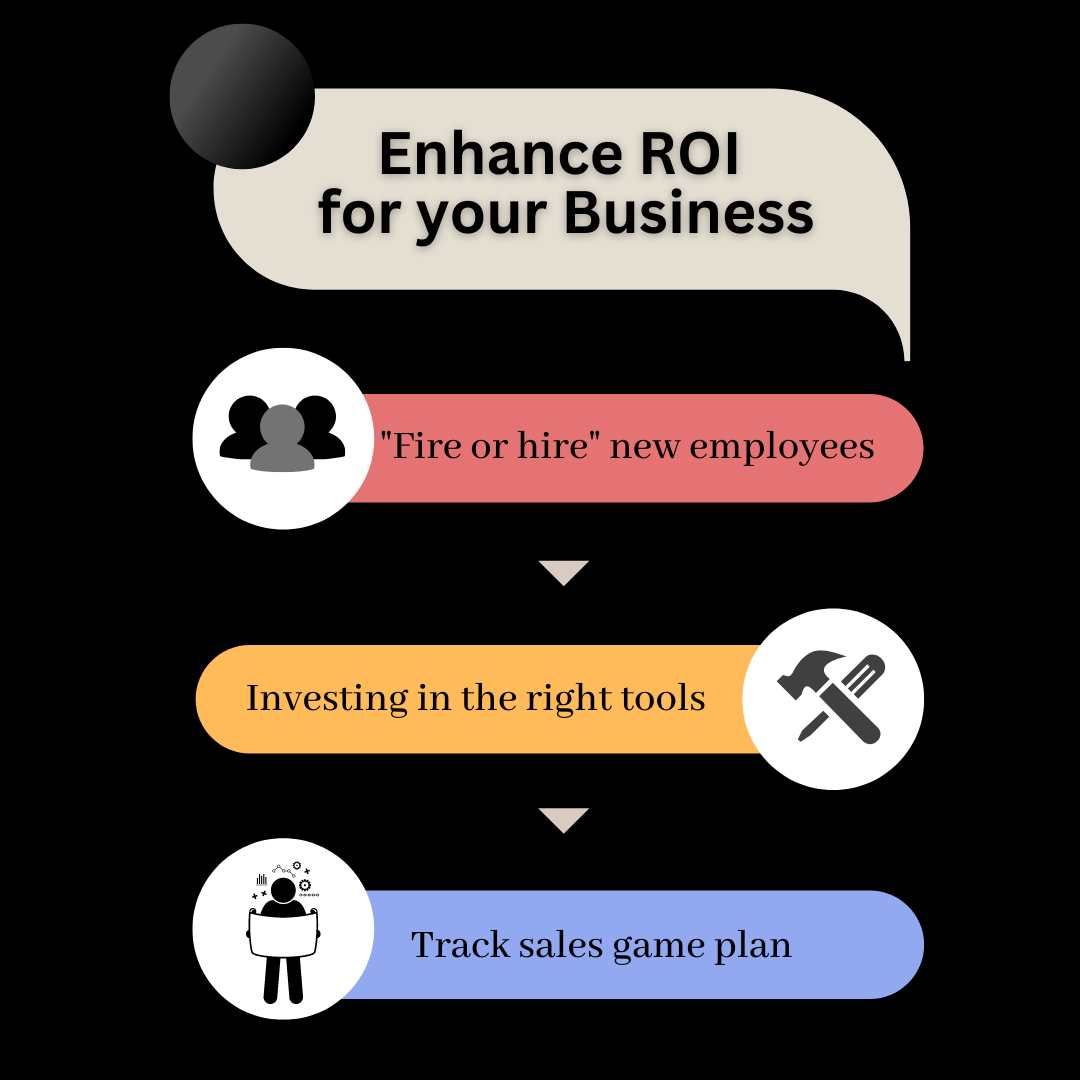

How can you enhance ROI for your business?

ROI calculation plays a pivotal role in analyzing the impact of investment, uncovers the incurring expense, and gives clarity to spend money in the right place. Let's look at how you can boost return on investment-

- "Fire or hire" new employees It’s always a wise move to evaluate whether the new employees make your business profitable or not. Monitoring employees' ROI helps you decide on the right candidate for the role and lets you know whether there is a need to retain them.

- Investing in the right tools With the advancement in the technological space, investing in the right equipment and tools has become necessary. Deciding which equipment you need to invest in going forward and worth the buy can be accessed effectively by the ROI of an equipment purchase.

- Track sales game plan Undoubtedly, sales strategies don't follow the "one-size-fits-all" approach. You need to explore business sales strategies that may help increase your business profitability and bring fruitful outcomes.

ROI Considerations to look for investment

Rather than choosing a simple benchmark, leveraging the right ROI for your investing strategy involves logical reasoning.

Here are some questions that you can try answering to evaluate the ROI that's right for you-

- How much is your risk tolerance level?

- Can you afford to bear this level of risk?

- How much profit do you expect from this investment?

- What if you fail to make any profit on your investment?

- What else could you do with this money if you don't make this investment?

ROI limitations

Investors leverage the ROI metric to assess an investment's value, but it is only one financial evaluation method. A major drawback is that ROI does not give a comprehensive picture of economic growth.

Two critical drawbacks to ROI are

Vulnerable to Manipulation

The computation varies depending on the investors; some rely on one factor while others completely ignore it, which makes it simple to manipulate.

The time factor independence

ROI doesn't incorporate a time element. The time required to attain capital gains doesn't factor into computing investment returns.

For instance, Company A provides a high return of 35%, and Company B offers a return of 30%. Which company do you choose to get the best return on investment?

Company A seems lucrative.

But what if company A returns 35% over five years, and company B provides 30% over two years?

Now, what's the wise decision to invest in?

Without a doubt, Company B!

Hence, the time required to achieve the desired capital gain is not included in ROI calculations which misleads the decision. Therefore, it is essential to look at the time frame before investing.

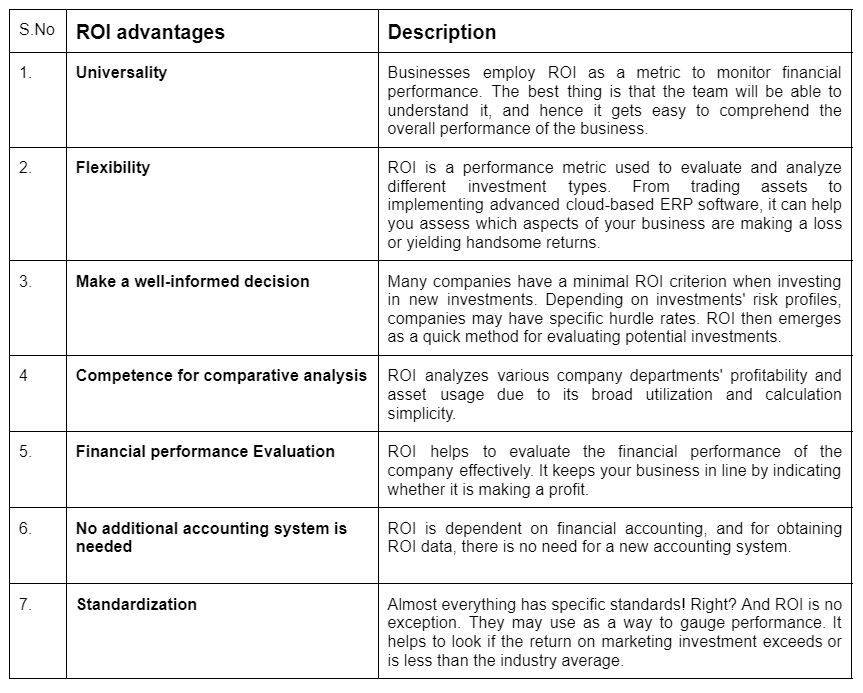

ROI advantages that you must know

Return on investment measures are essential to shape corporate strategies and make well-informed decisions. Let's discuss the numerous advantages of ROI in organizations-

That’s a wrap

Return on investment (ROI) is a widely used decision-making tool for assessing the investment's effectiveness and enabling you to determine which investment you should avoid. If you want to determine whether your marketing effort creates an impact and your company is growing as expected, leveraging the ROI calculation methodologies will be beneficial.

Nevertheless, investors cannot solely make decisions based on ROI as it does not involve risk mitigation and time horizon consideration.

However, if the business doesn't consider the limitations, it may lead to bad investments and loss of their hard-earned money.

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.