Share on

What makes Mensa Brands so unique?

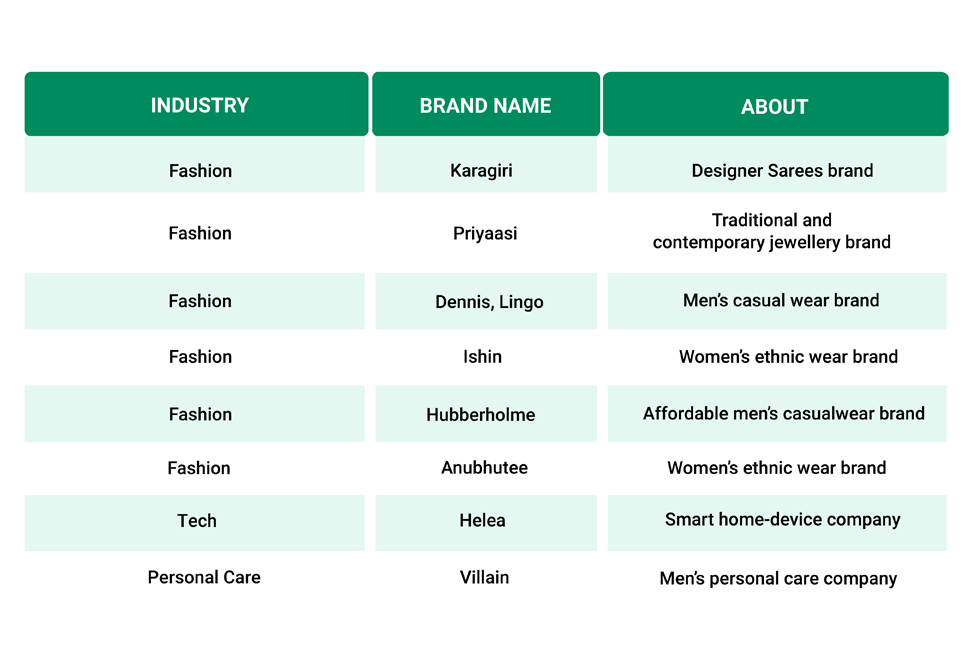

Built on the lines of popular American startup Thrasio, Mensa Brands identifies, acquires, and invests in online-first brands and scales them exponentially within the home market and overseas. To date, Mensa acquired a majority stake in 10 online-first brands across fashion and apparel, home and garden, beauty and personal care, and gourmet.

What's the business model of Mensa Brands?

Following the acquisition of these brands, the founders and their teams became part of Mensa. Together, they work closely to accelerate growth on marketplaces by applying a combination of initiatives across product, pricing, marketing, distribution, and brand building on global platforms and the brand's website.

How much funding did Mensa raise in these 6 months?

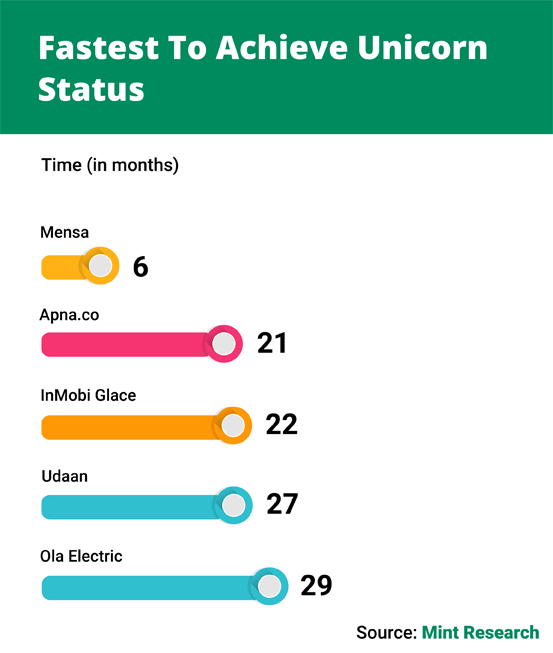

Mensa has raised a total of $300 million in equity and debt since starting its operation in May 2021. Mensa Brands raised $135 million from its existing investors in the Series B round - Accel Partners, Norwest Venture Partners, and Tiger Global Management. Prosus Ventures (Naspers).

Future Plans?

According to Narayanan, "the majority of the brands Mensa has acquired so far are growing at 100% year-on-year since their integration."

Mensa's vision is to acquire and invest in 50 digital-first brands across – home, garden, apparel, personal care, and beauty categories, and scale them exponentially.

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.