Share on

The world would have never known Nykaa if Falguni Nayar didn’t choose to quit her job to pursue a dream where her heart lies. An IIM graduate, she spent 19 years working as an Investment Banker with Kotak Mahindra Group before taking the massive leap of faith and embarking on an entrepreneurial journey in 2012.

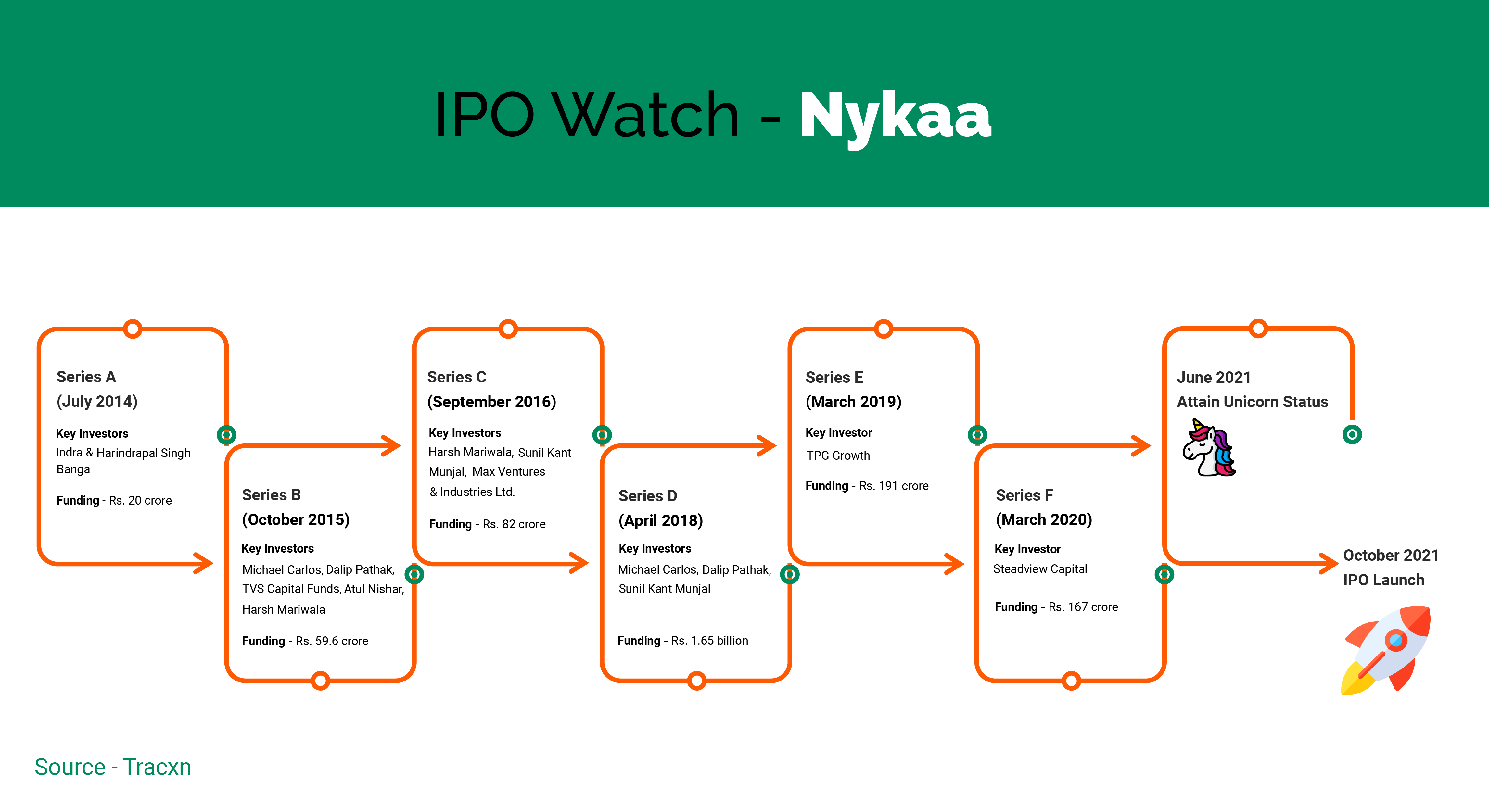

It may come as a surprise, but the $13.5 billion company only raised $100.9 million in over eight funding rounds. The key investors through these funding rounds are –

Series A (July 2014)

Key investors – Indra Banga, Harindrapal Singh Banga

In July 2014, Nykaa closed its first-ever round, where it raised Rs. 20 crore in Series A funding round. Harindarpal Singh Banga and his wife Indra Banga were the earliest investors in the beauty e-tailer.

Series B (October 2015)

Key Investors – Michael Carlos, Dalip Pathak, TVS Capital Funds, Atul Nishar, Harsh Mariwala

October 2015 saw Nykaa raising its first institutional capital. The Series B funding round is led by TVS Capital, and as reported, Nykaa diluted around 20% of its shares for Rs. 59.6 crore. Other key investors who participated in this round include Atul Nishar, Harsh Mariwala, Dalip Pathak, and Michael Carlos.

Series C (September 2016)

Key Investors - Harsh Mariwala, Sunil Kant Munjal, Max Ventures and Industries Ltd.

This round saw affluent Indian families cementing their interest in a rapidly growing e-commerce market space. In September 2016, Hero Group’s Sunil Munjal led an Rs. 82 crore in Series C funding round. Other participants in this round were Harsh Mariwala from Marico and Analjit Singh from Max Ventures.

Series D (April 2018)

Key Investors – Michael Carlos, Dalip Pathak, Sunil Kant Munjal

Nykaa closed its biggest-ever round in April 2018, when it raised Rs $24.45 Mn in the Series D investment round. The round saw exit from both primary investment and secondary exit of some early-stage investors. Among others, private equity veterans – Kunal Kant Munjal, Harsh Mariwala, and Dalip Pathak reinvested in this round.

TVS Capital Exit (September 2018)

Mid-market private equity firm Lighthouse Advisors Pvt backs beauty e-tailer Nykaa as TVS Capital exits. The deal saw a Mumbai-based PE firm investing Rs. 113 crore via an affiliate.

Series E (March 2019)

Key Investor – TPG Growth

The Spring of 2019 saw Singapore-based TPG Growth investing Rs. 191 crore in beauty e-tailer - Nykaa. During this round, Nykaa was in talks for an infusion of capital through dilution of the secondary stake sale, which invigorated interest from investors like Steadview Capital to pick up these secondary deals.

Series F (March 2020)

Key Investor - Steadview Capital

Asia-focused hedge fund Steadview Capital invested twice in Nykaa. First, as a part of the Series F round, they invested 100 crores and an additional Rs 67 crore months later.

June 2021 – Unicorn Status

Nykaa became India’s first women-led startup to attain Unicorn status.

October 2021 – IPO Launch

The three-day stake sale of Nykaa kicked off on 28th October 2021, intending to raise Rs. 5,352 crore from public issue.

How Much Nykaa Investors Made Post IPO?

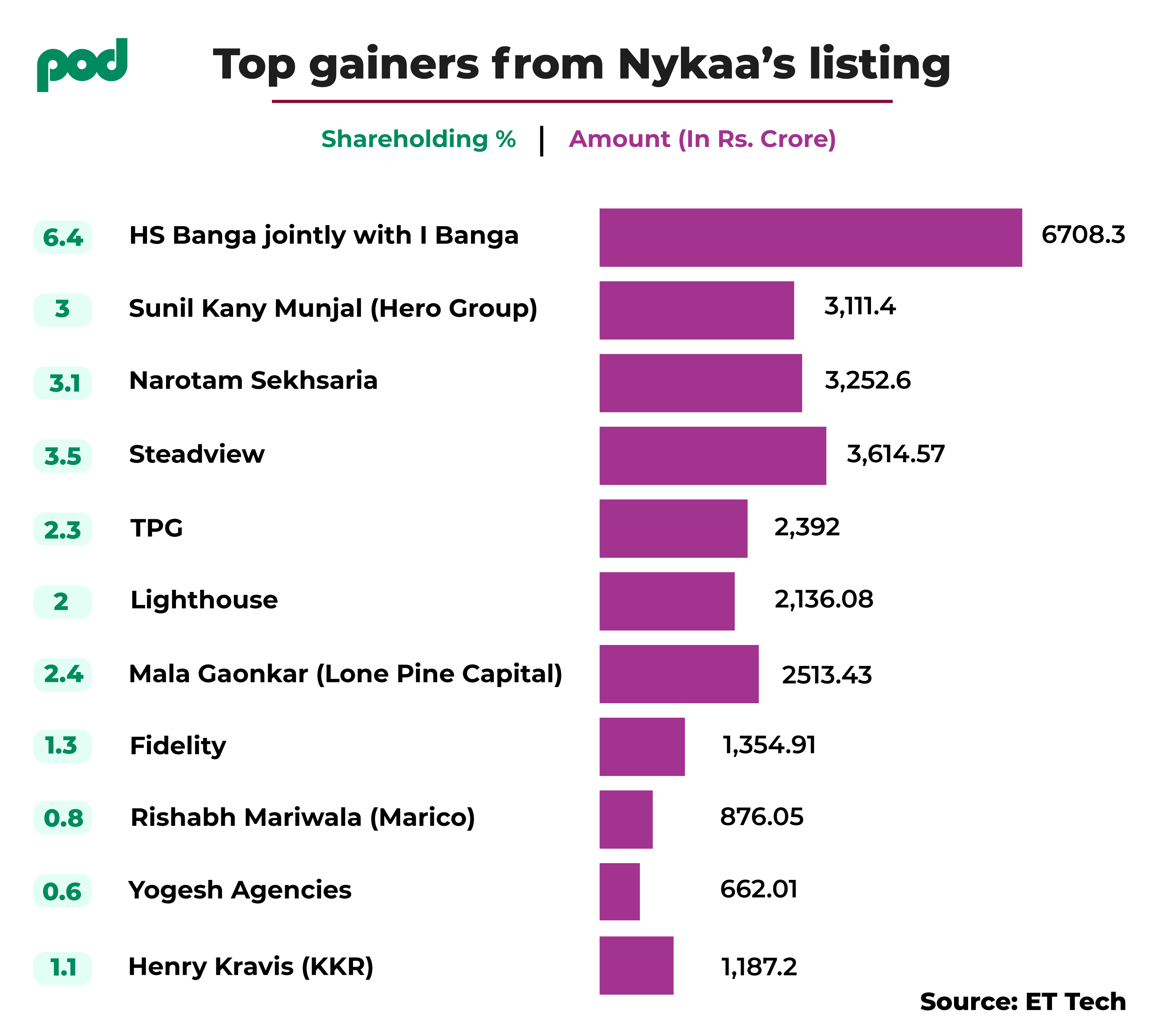

Nykaa made a fresh issue of 5.6 million shares during the IPO, where most of its early investors took the exit in this round. Over 88% of the IPO was OFS, and only 12% of it was a fresh issue, which indicated that Nykaa’s early investors took this opportunity to exit.

Falguni and her family - Sanjay, and their children, own a 53% stake in Nykaa parent FSN E-commerce Ventures.

Sanjay Nayar Family Trust sold 48 lakh shares at an offer price of Rs. 1125/ share through the OFS route in this IPO. In the process, the trust made an exit worth Rs. 540 crore.

Harindarpal Singh Banga and Indra Banga sold their 1.02 crore shares, the maximum by any investor, and Hero Group founder Sunil Kant Munjal sold 70.5 lakh shares under the OFS route.

A few early-stage investors like TPG Growth Fund and Lighthouse India Fund sold 54.21 lakh shares and 48.44 lakh shares, respectively.

Here’s the extensive list of top gainers from Nykaa’s listing -

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.