Share on

While the majority sided with “the best way to raise seed funds is by submitting pitch decks to VC firms,” some entrepreneurs weighed the importance of one pager and executive summary to get their foot inside the room full of investors.

When coming across “how to get funding for a startup,” every entrepreneur has their theory of how startup funding works at different stages of startup financing.

The unanimous takeaway from the interview reveals that creating one pager/executive summary/pitch deck is the first step to a fundraising campaign.

In this blog, we weigh the pros and cons of a one-pager, executive summary, and pitch deck to decipher the most effective method to approach investors for startup funding.

One Pager

One pager is a one-page document/pitch deck that offers an overview of the startup and provides important information in an easily digestible format. It highlights the startup's mission and vision, business model, and challenges they're looking to overcome.

PROS

- Since everything is collated on one page, an investor can easily evaluate the business plan and quickly decide.

- With its flexible design template, one pager stands out visually.

CONS

- The concept of a one-pager is not widely accepted.

- Limited information leaves investors with half the face of reality.

How to create a professional one-pager?

A professional startup one pager contains –

- Hook - The goal is to hook investors' attention. Communicate the mission of the startup with a catchy headline.

- Concise Communication - The one pager should only give away only important and necessary information.

- Key Selling Point - Through the startup's traction, revenue model, etc., highlight the key metrics.

- Core Team Members - Investors want to be confident that competent individuals are running the company. So do add team members to the one-pager to build credibility.

With the POD one-pager template, you can showcase a startup’s vision, target market, revenue model, competitive landscape, team, financials, and other key metrics in a visually aesthetic manner.

PS: Did you know you can create a professional one-pager in 5 minutes?

Executive Summary

An executive summary is a two- to three-page document providing insight into a startup. It includes a description of the product or service, target market, competitive advantages, and financial projections.

PROS

With an executive summary, you can highlight the most important components of the startup at the beginning. It expands on one pager and keeps investors interested while engagingly covering key business information.

CONS

An executive summary is a lengthy version of a one-pager with more words. A professional writer or editor is required to ensure the information flows smoothly across the executive summary and covers the important points.

How to create a professional executive summary?

Popular platforms offering professional executive summary templates, both free and paid, are as follows -

- HubSpot

- FormSwift

- Smartsheet

- Template.net

- TemplateLab

- Vertex42

Pitch Deck

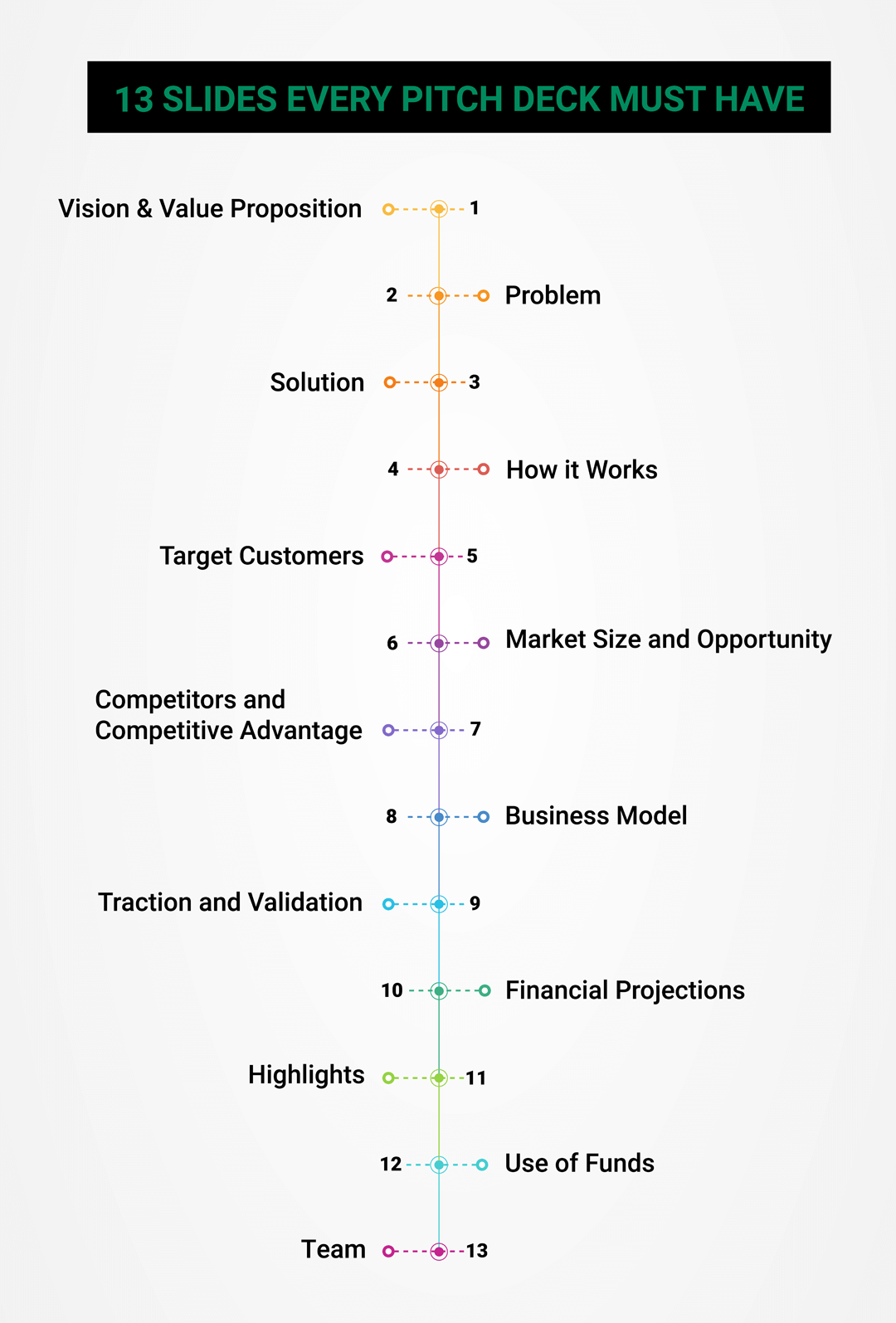

A pitch deck, also known as an investor pitch deck, is a multimedia presentation that captures the overview of a startup. It is most widely used by entrepreneurs to present the startup idea while raising funds. A professional investor pitch deck contains -

PROS

The pitch deck offers in-depth information about every aspect of the business. An investor can easily build a first-level view of the startup through a pitch deck.

CONS

Time-consuming – It takes time to collate all information that can help to fundraise. A pitch deck is expensive to make, as little customization is available on a free template. To create a professional pitch deck, you’ll require a designer.

How to create a professional pitch deck?

While creating a pitch deck, keep in mind -

- Make your pitch deck strong enough to stand on its own. The pitch deck should be able to tell the whole story, especially –

What do you do? Why are you 10x-100x better than the competition? How big is the opportunity?

- Do not overdo it with text/content, as it becomes time-consuming for investors to go through each slide in detail.

To improve the odds of your fundraiser, check out our blog – Proven pitch deck templates to increase the odds of your fundraising campaign.

After creating a pitch deck, don't forget to - submit your pitch deck to 2000+ investors.

Conclusion

There is no correct answer to this - "What is the best way to approach investors for funding?"

However, a well-crafted one-pager can be a great way to start a conversation with an investor, as it can quickly and briefly summarize the startup and its potential to investors. An executive summary is more appropriate for investors looking for more insights about the startup. At the same time, a pitch deck is typically used to give in-depth information about every aspect of the startup – team, product, marketing, financials, etc.

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.