Share on

In a recent survey conducted by CB Insights, "90% of startups fail because they ran out of cash/failed to raise capital." The number of early-stage startups looking for financial backing at the seed level is relatively high, but only a few get a nod from the Investors' groups/funds. To get the revolutionary idea rolling, these startups rely heavily on funding, which they use to accelerate and support their growth.

In this article, we have compiled a step-by-step guide for Early Stage Startups to successfully raise seed capital. We cover the basics of -

- What is seed capital?

- When should you raise seed capital?

- How to raise seed capital for your early-stage startup?

- How to successfully pitch your startup to investors?

What is seed capital?

It is the form of capital or money startups raise to develop an idea or a new product. With this capital, startups can prove that their concept works and get their product off the ground.

Since the business is not fully functional and has minimal exposure to the market, this form of investment is considered high-risk. As a result, investors providing seed capital often do so for a stake in the company (either equity, or seat on the board, or both.)

The capital raised in seed rounds is usually a smaller amount compared to other rounds, where the focus is more on building the product than scaling.

When should you raise seed capital?

Getting the timing right on raising seed funding is essential. Your business should have reached a certain level of maturity and milestones before you start actively approaching investors.

Here are some of the key milestones investors look for in an early-stage startup –

- Minimum viable product (MVP) with early signs of traction.

- Demonstrate potential for Product-Market Fit - the product or idea works and that there's a market for it.

- Key personnel in place with a strong founding team.

How to raise seed capital for your early-stage startup?

Regardless of your approach, the first step to getting seed funding involves creating essential documents like a pitch deck, followed by creating an investor list and choosing the right investor for your startup.

Step #1 – Create Pitch Deck

An informative pitch deck helps a startup consolidate its ideas and processes in a presentable manner. Entrepreneurs use pitch decks as a sales pitch to impress potential investors with detailed information on product development and goal management. It should also contain a fair financial model and projection that investors can analyze to understand the startup's spending in different areas and the important - cost of generating sales.

You can also be impressed with a much shorter version of the pitch deck – the executive summary, which is a two-page narrative of Pitch Deck content. It is the first thing, or in some cases, the only thing potential investors will read when they receive your business plan.

Step #2 – Build Targeted Investor List

Since your startup is relatively new and nobody knows about your revolutionary idea, it falls upon you to initiate the first dialogue! But with whom?

There are different investor groups/funds interested in backing a unique business plan. These are mainly -

Angel investors

These are high net-worth individuals who cherish the idea of making investments in exchange for equity or a set on the board or both. Apart from financially backing early-stage startups, an angel investor can adorn many roles that benefit the startup.

Angel Investment Platforms

Platforms like POD, present promising early-stage startups to the group of angel investors signed up on the platform. Through this angel investment platform, a startup can relish the opportunity to pitch to many potential investors at once. All you’ve to do is submit your pitch deck here.

Venture Capital Funds

VC funds can offer more significant investments for seed rounds but seem to evade it since the risk in these deals is relatively high. Also, they have a longer decision-making process, given that multiple limited partner investors represent these funds.

Step #3 - Choose The Right Investor

When thinking about which investors you want, depending on the kind of association, they can help you in as many ways as possible or take the backseat and enjoy your rise. It's helpful to look at a few different criteria before selecting an investor:

Industry Expertise

Getting an investment partner who can understand the ins and outs of your industry is always a good idea. With their deep knowledge of the industry, they can offer insights and practical advice on approaching the market and avoiding pitfalls in the process.

Network Strength

Through his network of seasoned investors, a well-connected investor can help you raise the funding for the next round. It can be helpful to do some research to identify their network connection.

Mentorship

An investor with a hands-on approach helps to solidify your business plan, product, etc. With their regular mentorship, you can efficiently scale your operations. An investor with deep pockets may look tempting, but if they lack experience with startups like yours, you're better off without their money.

How to successfully pitch your startup to investors?

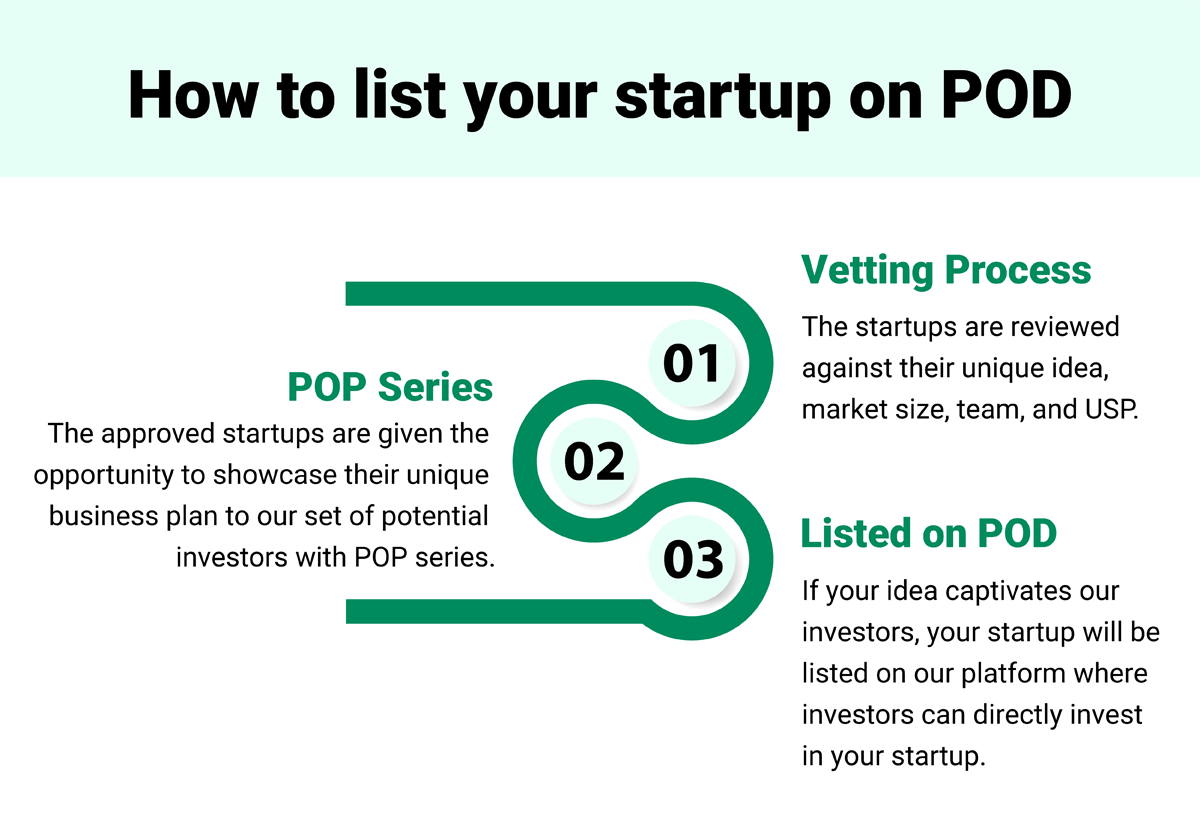

At POD, we have defined a process that works for early-stage startups to raise seed capital. The process begins with startups submitting their pitch deck –

Vetting Process: The startups are reviewed against their unique idea, market size, team, and USP.

POP Series: The approved startups are allowed to showcase their unique business plan to our set of potential investors with the POP Series.

Listed on POD: If your idea captivates our investors, your startup will be listed on the platform, where investors can directly invest in your startup.

You can submit your pitch deck here.

POD is owned by Crowdpouch Ventures Services Private Limited and reserves all rights to the assets, content, services, information, and products and graphics in the website but third party content. Crowdpouch does not solicit, advertise, market any of the users registered with POD, neither does it solicit investors by offering leagues/schemes/competitions etc. related to securities markets. POD hereby clarifies that it does not carry any resemblance to the stock exchange nor does it facilitate trading of securities nor does it act like a broker/agent/media for raising funds. Investment through POD does not carry rights of renunciation. Investors are cautioned that POD operates in an unregulated space hence, investment through POD is subject to investment risk. Investments in startups are highly illiquid.